重点通报!免税香烟厂家一手货源批发代理“避实击虚”

免税香烟市场的暗流汹涌:避实击虚的流通乱象

近年来,免税香烟市场乱象频现,而“避实击虚”的流通乱象更是成为行业痛点。所谓“避实击虚”,是指不法分子通过各种手段规避监管,逃避税收,非法牟利。本文将深入探究免税香烟“避实击虚”的流通乱象,揭示背后的利益链条和监管漏洞。

免税香烟流通乱象

免税香烟原本 предназначены для для duty-free shops and other designated channels. However, in recent years, a substantial portion of duty-free cigarettes have been smuggled into the domestic market, evading taxes and disrupting the legal tobacco industry.

The illicit flow of duty-free cigarettes has several major manifestations:

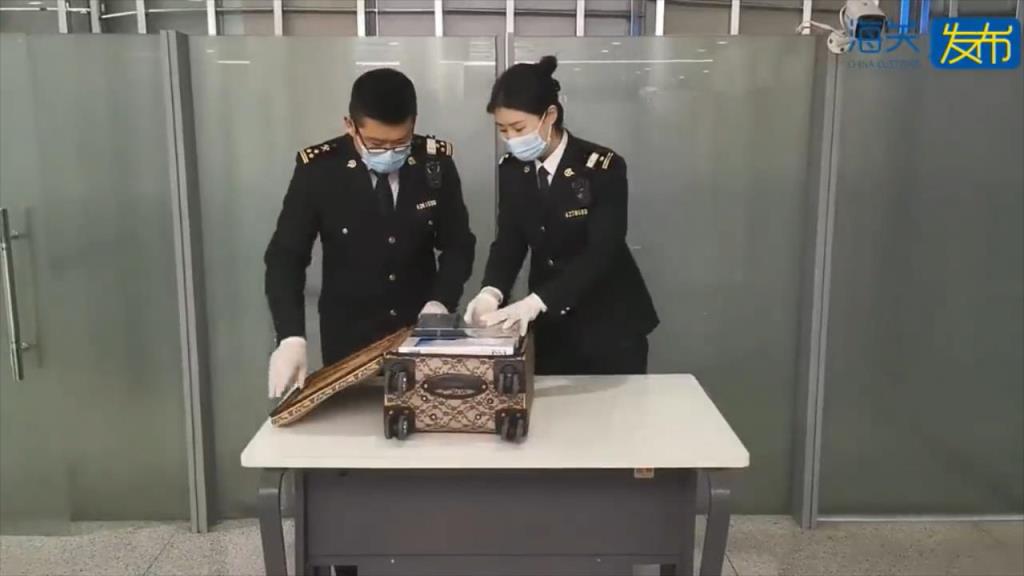

* Smuggling: Cigarettes are smuggled across borders, often via informal channels, to avoid customs inspections and tax payments.

* Counterfeiting: Counterfeit duty-free cigarettes are produced and distributed, often imitating the packaging and branding of legitimate products.

* Illicit diversion: Duty-free cigarettes are diverted from their intended channels, such as duty-free shops or travelers, and sold on the domestic market.

利益链条

The illicit trade in duty-free cigarettes is driven by a complex network of利益相关者,每个利益相关者都在其中扮演着特定角色:

* Manufacturers: Some unscrupulous manufacturers may evade taxes by producing duty-free cigarettes without proper licenses or reporting.

* Distributors: Distributors may purchase duty-free cigarettes at a lower price and sell them on the domestic market at a higher price, pocketing the tax difference.

* Retailers: Retailers may knowingly or unknowingly sell illicit duty-free cigarettes to consumers, often at below-market prices.

* Consumers: Consumers may purchase illicit duty-free cigarettes due to lower prices or the perceived status associated with duty-free products.

监管漏洞

The illicit trade in duty-free cigarettes has flourished due to several vulnerabilities in the regulatory framework:

* Lax border controls: Cross-border smuggling is facilitated by weak border controls and insufficient surveillance.

* Inadequate product tracking: The lack of effective product tracking systems makes it difficult to trace duty-free cigarettes throughout the supply chain.

* Limited enforcement: Enforcement of anti-smuggling and anti-counterfeiting laws is often inadequate, resulting in low deterrence.

* Corrupt officials: In some cases, corrupt officials may collude with illicit traders to facilitate the flow of duty-free cigarettes.

Consequences

The illicit trade in duty-free cigarettes has significant consequences for both the government and the legal tobacco industry:

* Tax revenue loss: The government loses substantial tax revenue due to the evasion of duties and taxes on illicit duty-free cigarettes.

* Market disruption: The legal tobacco industry faces unfair competition from illicit duty-free cigarettes, which are sold at lower prices.

* Public health concerns: Counterfeit duty-free cigarettes may not meet safety standards and may pose health risks to consumers.

* Reputational damage: The illicit trade in duty-free cigarettes damages the reputation of the legal tobacco industry and undermines public trust.

Addressing the Challenge

Addressing the illicit trade in duty-free cigarettes requires a comprehensive approach involving both regulatory and enforcement measures:

* Strengthening border controls: Improving surveillance and enforcement at borders is crucial to deter smuggling.

* Implementing product tracking: Establishing effective product tracking systems can help trace duty-free cigarettes throughout the supply chain and identify illicit activities.

* Enhancing enforcement: Strengthening enforcement of anti-smuggling and anti-counterfeiting laws is essential to deter illicit traders.

* Collaboration with industry: Engaging with the legal tobacco industry can provide valuable insights into illicit trade patterns and help develop effective countermeasures.

* Raising public awareness: Educating consumers about the risks and consequences of purchasing illicit duty-free cigarettes is critical to reducing demand.

The illicit trade in duty-free cigarettes is a complex and persistent problem that undermines the legal tobacco industry and deprives the government of tax revenue. Addressing this challenge requires a comprehensive approach that strengthens border controls, implements product tracking systems, enhances enforcement, and collaborates with industry and consumers. By working together, we can create a fair and transparent tobacco market that protects the interests of consumers, businesses, and the government.